Easily find the HSN Code or ITC HS Code along with their respective GST rates for your product using our HSN Code Search Tool. You can search by either the product name or the HSN Code, or alternatively, browse through our category list to locate your product's HS code.

The HSN Code, standing for Harmonized System of Nomenclature, is a standardized classification system for goods developed by the World Customs Organization (WCO). Known as the HS Code globally, it is utilized in India with 4, 6, and 8-digit codes to systematically categorize over 5000 products, ensuring global acceptance.

As an internationally recognized standard, the initial six digits of the Harmonized System (HS) Code are uniform across all countries. However, for more detailed classification, additional digits have been incorporated by individual nations within their own HS Code systems. For instance, India employs a 4, 6, or 8-digit classification, while the United States utilizes a 10-digit Harmonized Tariff Schedule (HTS) code.

Since the HSN Code is an internationally accepted standard for product classification, it serves as a logical identifier for goods in both domestic and foreign trade. This system enables efficient data collection and analysis of trade activities within and beyond national borders. Governments can leverage this information to inform macroeconomic policies related to commodity trade.

Updates to the HSN Codes, including changes in product descriptions, removal of defunct codes, and the addition of new ones, are managed periodically by the Directorate General of Foreign Trade (DGFT). These revisions are part of an ongoing effort to refine the HSN Code system.

How does the search for HS Code work?

Search By Product Name: Enter your product name to receive recommendations for the most relevant 4-digit HSN Codes. If the suggested codes aren't correct, click 'Search' for all possible matches. Select the appropriate 4-digit code to access detailed 6 and 8-digit HSN Codes for export-import purposes, along with applicable GST rates.

Search by HS Code: Enter the first 2 or 4 digits of the HSN Code. Click on the desired result to obtain more detailed information about the HSN code.

How to use HS code using Category List?We have categorized the list of HSN Codes into 23 broad sections under 'All Categories.' Navigate from this menu to view 2, 4, 6, and 8-digit HSN Codes. Find GST rates by clicking on the 4-digit codes.

In exports, ITC-HS Codes are mandatory, requiring an 8-digit HSN Code on the shipping bill; failure to do so can result in the loss of export benefits. Under GST, however, businesses with a turnover below Rs 1.5 crore or those registered under the Composition Scheme are not required to use HSN Codes.

The Structure of HS Code

There are 21 sections in HS Codes

Divided into 99 chapters, each defining a specific category of product.

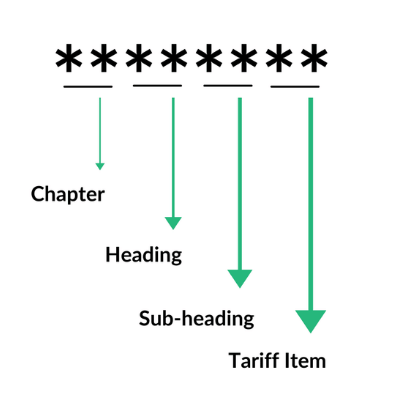

The Bifurcation of HSN Code: Chapters are further divided into headings, subheadings, and tariff items. In the 8-digit structure of an HSN Code, the first 2 digits represent the Chapter, the first 4 digits define the Heading, the first 6 digits denote the Subheading, and the full 8 digits specify the Tariff Item.

Earlier, HSN Codes were applicable only for Central Excise and Customs, but with the implementation of GST, businesses are now required to mention HSN Codes on their tax invoices and report them in GST returns. Additionally, the CBIC has established GST rates based on the HSN classification of goods. Therefore, to determine the GST rate for a product, businesses must first identify the correct HSN Code. Previously, the provisions related to HSN Codes under GST were issued by the Central Board of Indirect Taxes and Customs (CBIC) as follows:

Businesses with an annual turnover of up to Rs 1.5 crore are not required to mention HSN Codes.

Businesses with an annual turnover between Rs 1.5 crore and Rs 5 crore are required to mention HSN Codes up to 2 digits.

Businesses with an annual turnover exceeding Rs 5 crore are required to mention HSN Codes up to 4 digits.

The above notification was revised to mandate 4-digit and 6-digit HSN Codes on tax invoices for goods supplied, effective from April 1, 2021.

Businesses with an aggregate turnover of up to Rs 5 crore in the preceding year are required to mention HSN Codes up to 4 digits.

Businesses with an aggregate turnover exceeding Rs 5 crore in the preceding year are required to mention HSN Codes up to 6 digits.

Additionally, consider the following points:

For B2C businesses with a turnover up to Rs 5 crore, reporting 4-digit HSN Codes is not compulsory, whereas it is mandatory for B2B businesses.

Any business engaged in import-export transactions, governed by the Foreign Trade Policy and customs regulations, must mention 8-digit HSN Codes or HS Codes, as notified by the DGFT, on all invoices and customs paperwork.

In India, almost all goods are classified under the HSN system. Based on their turnover and nature of transactions, businesses must determine the 4, 6, or 8-digit code for their products. Considering this, here are three different scenarios:

Scenario 1:Mr. A, a domestic trader supplying cement, needs to identify the HSN Code for issuing his tax invoices. With an annual aggregate turnover of INR 4.5 crore, Mr. A requires a 4-digit HSN Code for his product. After conducting research, he finds that HSN Code 2523—Cement, including cement clinkers, whether or not colored—is the most appropriate code for his product. He then uses this code in his invoices and GST returns.

Scenario 2:If Mr. A's annual turnover exceeds INR 5 crore, he would need to report a 6-digit HSN Code. In this case, he would identify the precise 6-digit HSN Code based on the specifications of his product. For instance, if his cement is aluminous cement, he would determine that HSN Code 252330 is the most accurate and use it accordingly.

Scenario 3:Mr. A also exports cement to the USA. For completing his customs paperwork and issuing invoices, he needs to report the correct HSN Code. Given that this transaction involves exporting goods, it is mandatory for Mr. A to use an 8-digit HSN Code for his product. After determining that the appropriate 8-digit code for aluminous cement is HSN Code 25233010, he prepares his export documents accordingly.

There are 21 sections in HSN Codes, divided into 99 chapters, each defining a specific category of product. These chapters are further subdivided into headings, subheadings, and tariff items. In the 8-digit structure of an HSN Code, the first 2 digits indicate the chapter, the first 4 digits define the heading, the first 6 digits specify the subheading, and the full 8 digits identify the tariff item. All 8-digit HSN Codes are mandatory for exports and imports under GST. (HSN codes have been required since April 1, 2021.)

The Harmonized System of Nomenclature (HSN) Code is used for classifying goods under GST and is issued by the World Customs Organization (WCO). It categorizes commodities under various sections, chapters, headings, and subheadings based on their nature. The Services Accounting Code (SAC) is utilized for classifying services under GST and is issued by the Central Board of Indirect Taxes and Customs (CBIC). Each service is assigned a unique SAC code. Both HSN and SAC codes make the GST return filing process more systematic and simpler.

ITC stands for Indian Trade Classification or Indian Tariff Code, and ITC-HS was adopted in India for import-export operations. ITC HS Codes are divided into two schedules: the first includes an 8-digit nomenclature, and the second provides descriptions of goods. The primary difference between ITC-HS Codes and HSN Codes is that ITC adds two more digits to the 6-digit HSN structure to classify 'Tariff Items.' This extension is made within the regulations of the HS system set up by the World Customs Organization (WCO), without altering the existing structure.

As an exporter, using an incorrect HS Code can lead to issues during customs inspection, such as denial of import privileges, heavy custom duty charges, and non-compliance penalties. Under GST, using an incorrect HSN Code means the buyer cannot claim input tax credit. According to Section 31, an invoice must be complete in all respects, including the correct HSN classification, to claim input tax credit.